Most custodian managed self-directed IRA plans cannot provide this kind of flexibility, or have rather cumbersome and expensive methodologies for keeping idle capital deployed in conventional financial products. A Custodial IRA is an account that a custodian (typically a parent) holds for a minor with earned income. These include tax liens, private equity, oil and gas leases, peer-to-peer loans, and even raw land, among other asset types. We can help with any self-directed 401k/IRA needs. But you can also store other types of assets not permitted in regular IRA accounts. If you have both bank and brokerage accounts within the IRA LLC, you can simply move funds between these accounts without need for special processing or reporting. An SDIRA is an IRA in which you can hold alternative assets, particularly physical assets, like gold bullion and real estate. If you want to get more sophisticated, you can open a brokerage trading account in the name of the LLC, then take the rental income from an IRA-owned property and invest that into shares of your favorite stock or mutual fund. When it comes to contingency funds, something that is reasonably safe and easy to liquidate is best. You can keep things simple and just have a savings account for the LLC, or perhaps put some portion of the LLC funds in short-term CD’s.

CHECKBOOK IRA FULL

Because you have full control over your plan, and the ability to invest in absolutely anything the IRS rules allow, you can easily keep all of the capital in your IRA LLC deployed rather than leave these funds in cash. With any self-directed IRA portfolio, you are likely to have two types of potentially idle capital: contingency reserves and new income from investments. Trade commission-free stock and exchange.

CHECKBOOK IRA PROFESSIONAL

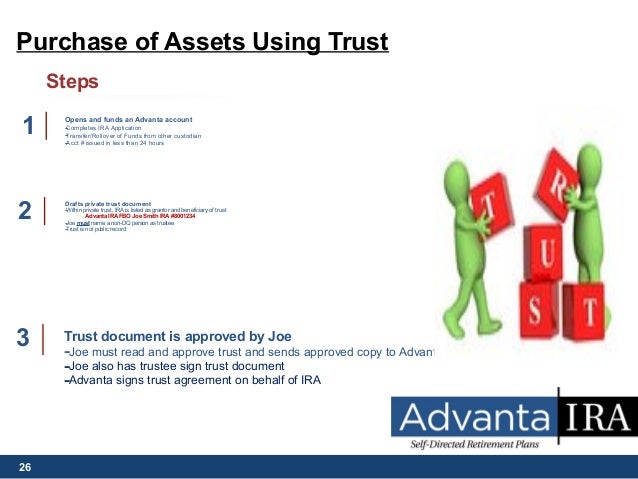

The simpler, less-expensive method of gaining access to these investments is the self-directed IRA with a traditional custodial arrangement. Guaranteed income and professional investing advice and access to 150+ mutual funds. Compare Plans – See which plan best suits your situation and goals. A checkbook IRA arrangement isn’t necessary to invest in alternative assets like cryptocurrencies, physical precious metals, real estate or other investments you won’t find in your 401(k).Start or grow your business with your IRA or 401k. Business Funding IRA – Invest in yourself. The Checkbook IRA, written by tax attorney Adam Bergman, reads like an easy-to-understand conversation between a lawyer and his client, addressing the most.

CHECKBOOK IRA PLUS

Typical charges include a one-time establishment fee, a first-year annual fee, an annual renewal fee, and fees for investment bill paying.

Make sure you understand and follow the rules for the specific assets that you hold in the account. And you’ll be on the hook for all the taxes plus a penalty. Easy to accidentally violate a rule and distribute the entire account: If you break a rule, the entire account could be considered distributed to you.

0 kommentar(er)

0 kommentar(er)